White House confirms deadline for international trade deals

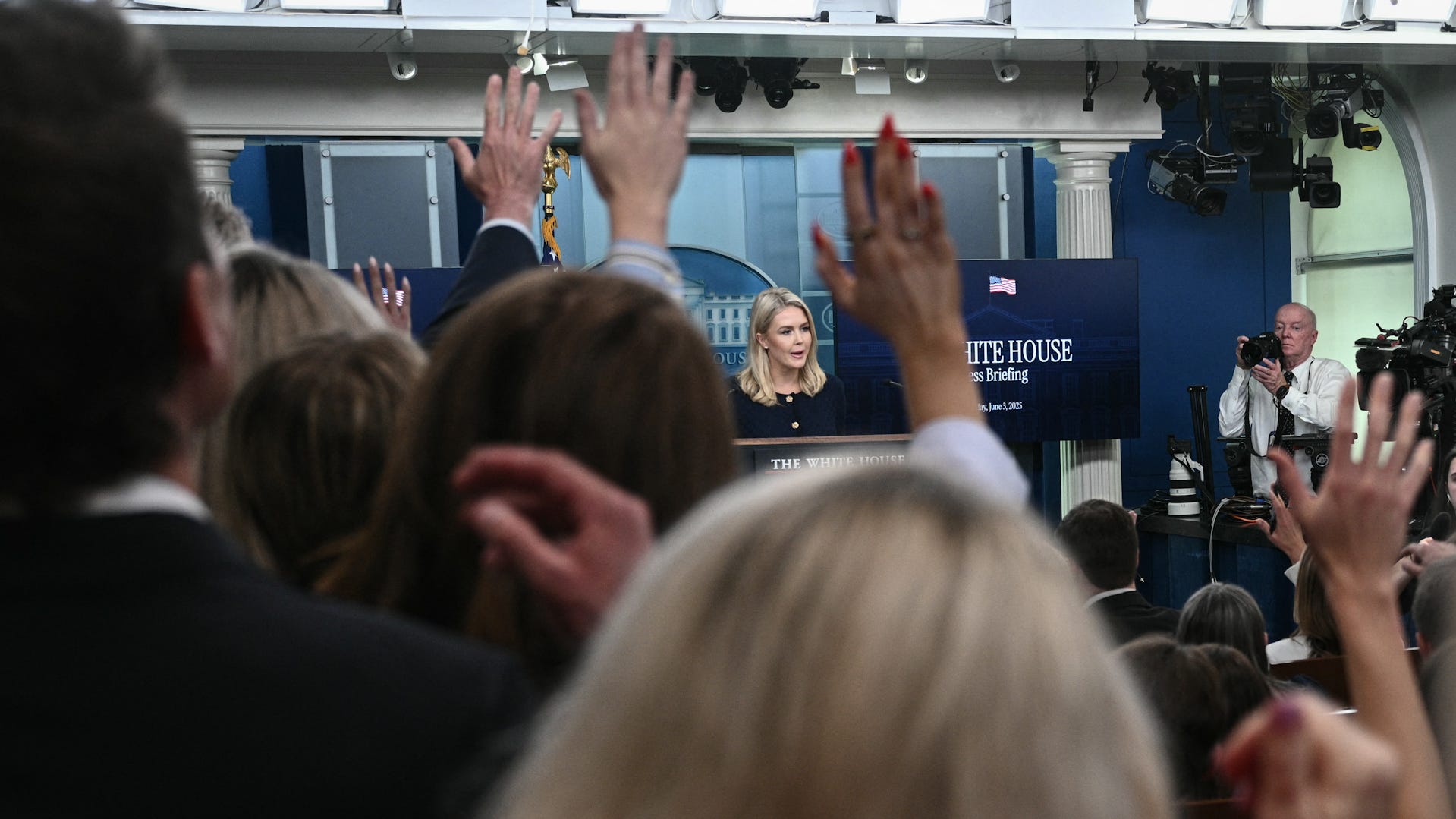

White House Press Secretary Karoline Leavitt confirmed the administration has sent a letter to all of its trading partners ahead of a tariff deadline.

Stocks closed little changed as U.S. officials made little progress on trade war negotiations and incoming economic data turned increasingly negative.

The broad S&P 500 index was unchanged at 5,970.81. The blue-chip Dow Jones Industrial Average lost 91.90 points, or 0.2%, to close at 42,427.74. The Nasdaq Composite gained 0.3%, or 61.53 points, to close at 19,460.49.

President Donald Trump said he expected a call with Chinese leader Xi Jinping this week to discuss trade, though he also suggested it might be an uphill battle. “I like President XI of China, always have, and always will, but he is VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!” the President wrote on social media.

Economic news and interest rates

Meanwhile, investors also await the Labor Department’s monthly jobs report at the end of the week. The report could be a barometer of how much, if any, businesses are delaying hiring due to tariffs.

On Wednesday, payroll processor ADP said private-sector firms added just 37,000 workers in May, the lowest since March 2023, and well below Wall Street’s expectations of 115,000 workers. April’s tally was also revised down. ADP’s report is sometimes seen as a harbinger of the official government release, though it often misses the mark.

After the ADP report release, Trump called Federal Reserve Chair Jerome Powell “unbelievable” on social media, and again urged him to lower interest rates.

The bond market sold off in the wake of the release: 10-year U.S. Treasury notes fell about 9.5 basis points to about 4.365%. Bond yields fall when prices rise, and fixed income investments become more attractive in periods of slowing economic growth.

Also on Wednesday, the nonpartisan Congressional Budget Office said Trump’s tax bill will increase deficits by $2.4 trillion over the next decade. Investors and analysts have warned that elevated deficits will lead to higher interest rates, since the U.S. government will need to pay more to attract investors to buy its debt.

Meanwhile, a closely-watched gauge of business activity in the service sector fell below the line that separates growth from contraction in April. ISM’s Services PMI was at 49.9 in May, the lowest in a year, and a reminder of the impact of trade war uncertainty.

In the afternoon, a report on economic activity from the Federal Reserve found that economic activity had declinedslightly since the previous report, six weeks prior. “On balance, the outlook remains slightly pessimistic and uncertain, unchanged relative to the previous report,” the Fed’s Beige Book said.