Federal officials warn of unpaid toll scam texts coast to coast

People across the country are getting scam texts demanding they cough up unpaid tolls or else. Here’s what you need to know.

Straight Arrow News

- If you paid up or attempted to pay after receiving a scam text, call your card issuer. Make sure to call the number on the back of your debit card or credit card that you’ve used.

- If you initiate a credit freeze, you can stop crooks from opening new credit cards or loans in your name.

Now what do you do? You hate to admit it, but that alarming text message got you so frazzled that you responded to one of those fake DMV texts or a toll road text that we all seem to be getting now.

It happens.

We’re getting a ton of alerts about how we should not believe any text that claims to be from the so-called “Department of Vehicles” threatening enforcement actions or fall for any of those crackpot toll road texts.

But what should you do if you quickly responded to a text?

First, kick the shame and blame thing to the curb. Scammers play games because they know people get distracted and can be more vulnerable to a scam on some days than others. I like to say crooks know how to break into your house; scammers know how to break into your psyche.

Many of us cannot resist just ignoring a troubling text. If we respond, crooks know they’ve got a great shot at making some good money.

Toll imposter scams rang up a median loss of $7 in the first quarter of 2025, according to the Federal Trade Commission. Criminals, though, are not actually interested in small change for unpaid tolls.

“Scammers may try to reuse your card number in other places, and it’s important to dispute the fraudulent charge as soon as possible so your bank can block future attempts,” a spokesperson for the American Bankers Association told the Detroit Free Press, part of the USA TODAY Network.

Often, the text message may direct you to websites to purportedly pay a late toll or outstanding traffic ticket. In many cases, consumers who entered a credit card number reported that they were then told that the payment failed. So they needed to try another card.

The scammer, of course, is harvesting as many credit card numbers as possible to use to buy popular items to later resell.

Why the toll text scams are growing

We’re uncertain about how a lot of things in life work these days — such as new “pay by plate” toll systems being installed in a variety of states.

“Scammers are exploiting this uncertainty,” said Florian Schaub, associate professor at the University of Michigan School of Information.

Often, he said, toll companies will send you an invoice by regular mail that features a photo of your car taken at a toll gantry or booth, which helps you verify that it is a legitimate invoice. You’re not going to get an unexpected text weeks or months after taking a trip, but most people don’t understand that.

The well-respected Krebs on Security report indicated that phishing attacks spoofing toll road operators skyrocketed early in 2025, “when at least one Chinese cybercriminal group known for selling sophisticated SMS phishing kits began offering new phishing pages designed to spoof toll operators in various U.S. states.”

The ultimate goal of these scams, according to the report, is to obtain enough information from victims so that a consumer’s payment card can “added to mobile wallets and used to buy goods at physical stores, online, or to launder money through shell companies.”

Right now, experts say, scammers running the DMV or toll road text scams seem to be selecting phone numbers at random — not necessarily using phone numbers associated with a specific account or “pay by plate” technology.

The Federal Trade Commission said in April that reports of dollars lost to text scams skyrocketed. In 2024, people reported losing $470 million to scams that began with a fake text. That’s more than five times the amount of money that was reported lost in 2020. Remember, most frauds are never reported, so even more people likely lost some cash.

Amazingly, bogus notices about unpaid tolls ranked No. 4 among the top 5 text scams in 2024, according to the FTC. The other top text scams involved fake package delivery problems; phony job opportunities; crooks impersonating Amazon, your bank or others; and the so-called wrong number text where you kindly respond to a scammer when you think you’re helping a real person.

Here are the steps to take if you’ve been scammed:

Call your bank and credit card issuer

If you paid up or attempted to pay after receiving a scam text, call your card issuer. Make sure to call the number on the back of your debit card or credit card that you’ve used.

Do not call any number shared to you via a text because that number might connect you to scammers. Crooks have the ability to spoof caller IDs and plant bogus customer service information online.

You’d want to inquire about having your credit or debit card canceled soon and have a new card issued so the crooks no longer have access to your card number.

Limit the damage

If you have clicked on a link and it takes you to a website, the FTC recommends not interacting with that website. Don’t enter any information.

Change your passwords

You may unknowingly have given your password or PINs to the scammers in some fashion. Change your passwords, especially ones related to financial accounts and email, said Carma Peters, president and CEO of Michigan Legacy Credit Union.

“This way you can stop any potential hacker that hasn’t had a chance to try your account yet.”

Another tip: Never give log ins and passwords to anyone, even family members. Peters noted that a lot of fraud can occur with friends and family, too. If you give your information to family or friends any loss will not be able to be recovered, she said, unless you are willing to prosecute them.

Watch out for problems

If you’ve clicked on a link, the best guidance is to move forward and take some steps as if you’re a victim of ID theft, according Danny Wimmer, press secretary for the Michigan Attorney General.

Make sure to secure your personal and financial information, recognizing that some accounts could be vulnerable to hackers. The official Identity Theft Support page offers some tips that can help.

Check your credit report

Carve out a bit more time over the coming months to make sure that no one is opening new lines of credit. You can get a free credit report each week from Equifax, Experian and TransUnion by going to annualcreditreport.com. You’d need to dispute any fraud that you spot on credit reports.

Keep an eye on your statements

You’d want to regularly review your bank statements and credit card statements, as well as your credit reports, to watch for unusual charges, suggests Nakia Mills, vice president of digital marketing and brand strategy for the Better Business Bureau of Michigan in Southfield.

Freeze your credit

If you initiate a credit freeze, you can stop crooks from opening new credit cards or loans in your name. A credit freeze is always a good idea, experts say, even if you didn’t respond to a fake text. You’d unfreeze your credit when you plan to go shopping for a car loan, credit card or other loan.

“Everyone should have a credit freeze. Period,” Schaub told USA TODAY earlier this year.

“If you don’t have a credit freeze, you’re leaving yourself open to scams and potential identity theft.”

A freeze is not the same as a fraud alert, which only tells businesses to check with you before opening a new account in your name and does not prevent businesses from seeing your credit report.

The three big credit reporting agencies — Equifax, Experian and TransUnion — are required to offer you a credit freeze, free of charge. Such a freeze will restrict access to your credit file and help stop crooks from opening credit cards in your name.

You must request a freeze by directly contacting each of the three major credit reporting bureaus — Equifax, Experian, and TransUnion — online, by phone or through the mail. Online you’d go to the following sites:

Equifax — www.equifax.com/CreditReportAssistance; Experian — www.experian.com/freeze; TransUnion — https://freeze.transunion.com.

File a report

If you lost money, the American Bankers Association, recommends that you file a police report.

You can report scam texts to the Federal Communications Commission online at consumercomplaints.fcc.gov or call 888-225-5322.

You also can report fraud, scams, or bad business practices to the Federal Trade Commission at ReportFraud.ftc.gov. Or you can call 877-382-4357.

The FTC cannot resolve your individual problem, but the agency uses reports to investigate and bring cases against fraud, scams and bad business practices. Information is shared with more than 2,800 law enforcers.

Another good step: File a complaint with the FBI’s Internet Crime Complaint Center at www.ic3.gov to provide more information about cyber-enabled crimes. The spot also lists some alerts to complex ongoing scams.

You can also report scams to the Better Business Bureau at BBB.org/ScamTracker to help make others aware and prevent future scams.

Report ID theft

A good online resource continues to be IdentityTheft.gov, which is a federal government resource to help people report and recover from identity theft.

Get rid of fake texts

The FTC recommends that you report and delete unwanted text messages. Use your phone’s “report junk” option to report unwanted texts to your messaging app or forward them to 7726. Once you’ve checked it out and reported it, delete the text.

How to avoid more scams ahead

As we get more fake texts, it’s good to keep some general practices and tips in mind to avoid future scams.

Be aware that you could be a target: Crooks often sell or use old lists of contact information for previous scam victims. The con artists behind the original scam could very well send the next text for a new scam.

Do not reply directly to texts: Among other tips, the Michigan Attorney General suggests that you do not reply, even if the message says you can “text STOP” to avoid more messages. “That tells them your number is active and can then be sold to other bad actors.”

Texts are a way for criminals to send millions of fake alerts at the same time. “Because smartphone users are three times more likely to fall for fake text messages than computer users are to fall for fake email messages, text message scams are on the rise,” according to the Michigan AG’s consumer protection office.

“Scammers know that you will do anything to protect your hard-earned money and take immediate action by responding and following instructions.”

Don’t click on links: U-M’s Schaub pointed out that phones now by default make links from unknown senders not clickable.

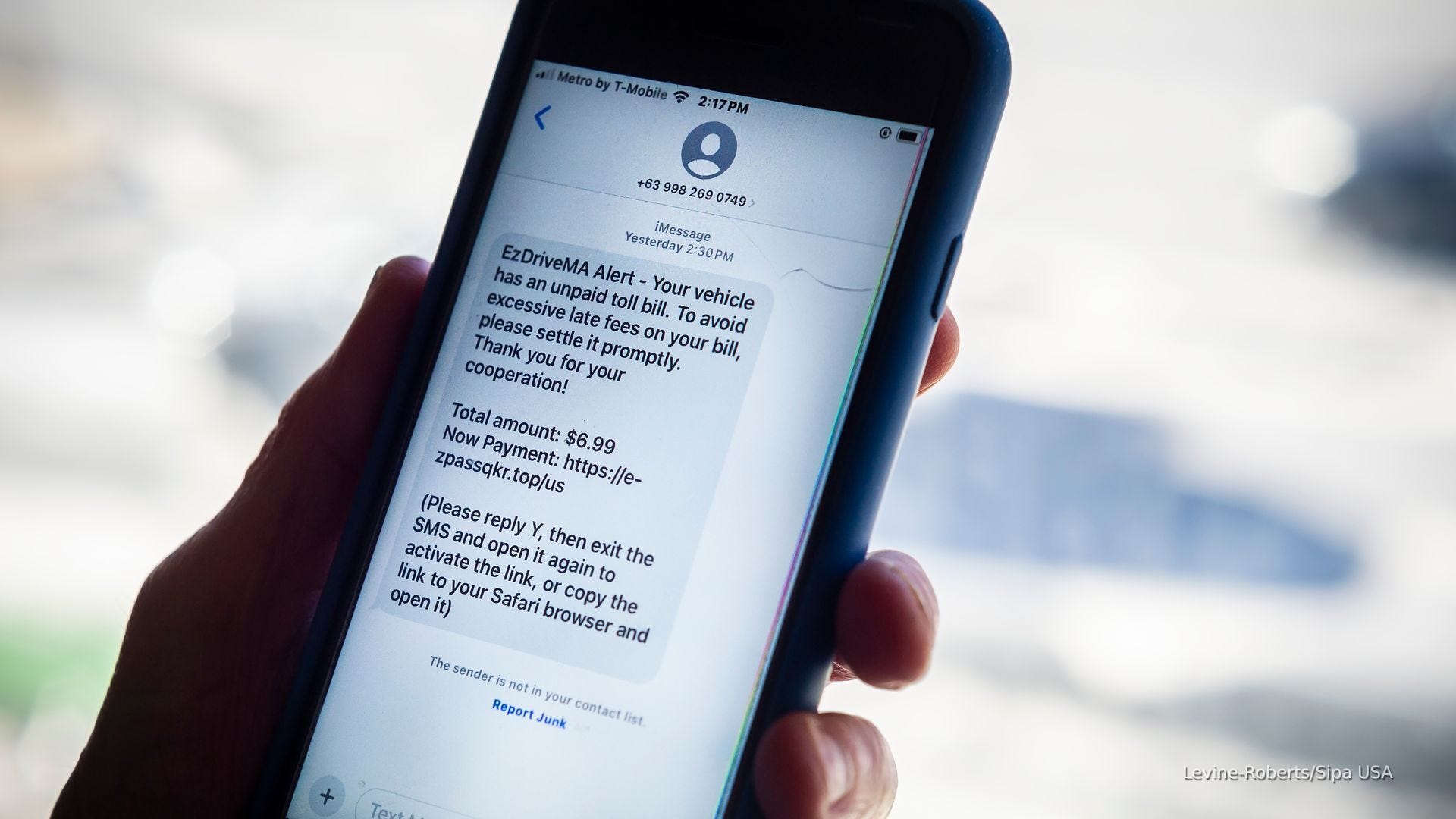

As a way around that one, you’re likely going to spot instructions in one of these DMV or toll scams that say: “Reply Y and re-open this message to click the link, or copy to your browser.”

“This is a tell-tale sign that you’re likely dealing with a scam,” Schaub said.

The FTC recommends that consumers do not click on any links in, or respond to, unexpected texts.

Who is texting anyway: Take a close look at who is really texting. Is it from a number that begins +63 — which indicates the call originated from the Philippines? Or are you looking at some odd email?

“Scammers want you to react quickly, but it’s best to stop and check it out,” said FTC spokesperson Juliana Gruenwald Henderson.

The FTC recommends that you reach out to the state’s tolling agency — or your bank if the text appears to be from your bank — using a phone number or website you know is real, not the information from the text.

Most of us need to stop, take a break here and realize we’re getting way more texts from crooks that our real connections. Delete, don’t respond.

Contact personal finance columnist Susan Tompor: stompor@freepress.com. Follow her on X @tompor.