If Congress passes President Donald Trump’s proposed tax cuts, we are confident that a surge in economic growth will help offset the federal deficit.

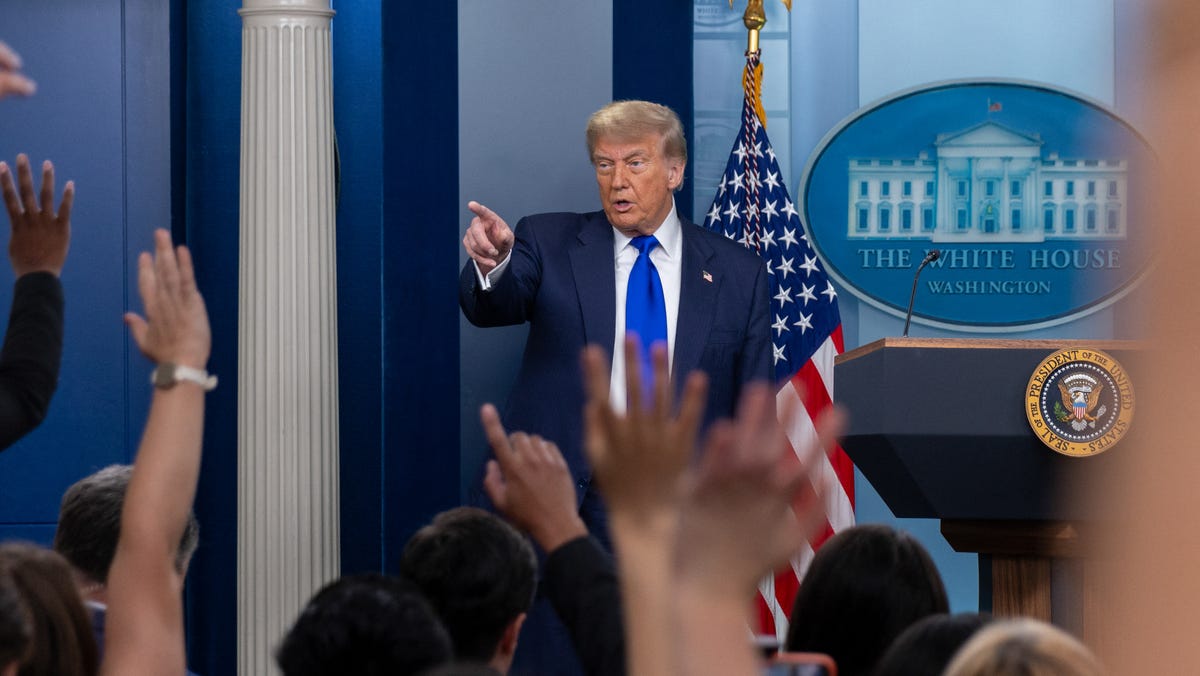

Senate votes to move forward with tax and spending bill

President Trump’s bill passed a key procedural vote in the Senate. Lawmakers voted 51-49.

The Senate is debating an extension of the Tax Cuts and Jobs Act of 2017 and passage of additional policies such as no tax on tips and overtime and a new tax credit on Social Security benefits. As the Senate considers these matters and assesses the appropriate level of spending cuts, the lessons of history provide an essential guide.

Before Congress passed the Tax Cuts and Jobs Act (TCJA) in 2017, President Donald Trump’s Council of Economic Advisers (CEA) examined a large, peer-reviewed literature to estimate the economic effects of the bill.

CEA’s key estimate at the time was that real median incomes would increase by $4,000 in the long run as businesses built new factories and created new jobs, boosting workers’ wages along the way. In fact, incomes rose by $6,400 in just two years with across-the-board surges in economic activity before COVID-19 lockdowns temporarily upset the economic momentum created by the TCJA.

It is interesting to us as economists that the 2017 White House modeling was confirmed by new evidence drawing on post-2017 data. A 2024 review by Michael Faulkender, deputy secretary at the Department of the Treasury, and Aaron Hedlund, chief economist at CEA, finds that the economy, in fact, outperformed expectations.

Tax cuts will spur economic growth

The economy today is even more responsive to tax changes than was projected by President Trump’s CEA in 2017.

As the Senate considers next steps, it first must accurately peg the effect of proposed changes against the correct counterfactual. If the extension of the Tax Cuts and Jobs Act of 2017, together with the other additional proposed measures, does not pass, the United States will experience the largest tax increase in our country’s history.

President Trump’s current CEA has estimated that this would sharply slow economic growth, reducing GDP by 4%, costing 6.1 million full-time equivalent jobs and reducing federal revenues by roughly 6%.

Perhaps the biggest drawback of the expiration of the TCJA would be the repeal of pro-growth business tax reforms, for businesses both small and large, that drive capital formation. Given the latest estimates from the literature evaluated in a CEA report published in May, the expectation is that passage of the One Big Beautiful Bill Act will result in an investment surge of up to 14.5%, driving real median incomes up by $10,000 relative to the scenario in which the TCJA is allowed to expire.

Some arguments raised against the bill warrant a response. First, some say the tax cuts are fiscally irresponsible. The Congressional Budget Office estimates that the House version of the bill would reduce revenue by $3.7 trillion over 10 years and increase the deficit by $2.4 trillion. The Senate version, according to the CBO, would add $3.3 trillion to the debt over the next decade.

The true budgetary impact, however, depends on whether the tax cuts generate growth, and from that additional economic activity, more revenue, as has been the case in the past.

If growth rises to 3% propelled by administration policy, then revenue over the next decade will rise by $4 trillion relative to the total revenue that would be collected if growth averaged only 1.8%, which is the CBO’s current estimate.

That amount of revenue is more than the current CBO estimate of the total “cost” of the House bill − a score that counts as a major cost simply leaving in place the tax cuts of 2017.

Tariffs will help offset cost of tax cuts

In addition, the CBO put out a separate score that the president’s current tariff policies will raise $2.8 trillion over the next 10 years, which would help to offset the CBO’s composite score of the bill. That number is not taken into account in the CBO’s assessment of the tax bill.

In 2017, opponents of the TCJA asserted that it would dramatically increase the deficit. In 2017, before the tax cuts, federal revenue relative to GDP was 17.1%. Despite the massive reduction in marginal tax rates, revenue relative to GDP in 2024 was the same: 17.1%. While the corporate tax rate was taken down from 35% to 21%, corporate tax revenue increased from 1.5% to 1.8% of GDP.

So why have deficits skyrocketed?

While revenues have kept up as a result of the economic activity the tax bill generated, spending today is roughly 3 percentage points of GDP higher than it was in 2017. The idea that the tax side of the equation is solely responsible for deficits is simply incorrect.

Another argument raised is that the bill will cause inflation to pick up as growth takes off. Those with this view, of course, fail to account for the fact that a factory spending boom that increases U.S. production drives down inflation by increasing supply. The Biden administration threw fire on inflation with government spending and used skyrocketing regulations to impede supply. To see the effect of today’s proposed policies, look no further than the 2017-19 acceleration in growth that was accompanied by low, stable inflation.

A third argument raised is that the United States does not have enough workers to meet the demands of a fast-growing economy. But this is why the plan is to cut taxes and stimulate work for those citizens earning overtime, making tips or returning to the workforce after retiring.

The evidence shows that these workers, who represent the bulk of the American middle and working class, are among the most responsive to tax policy in the overall economy.

As businesses invest in the United States and create new job opportunities, the workers will be there and, as experience has taught us, be richly rewarded.

Kevin Hassett is director of the White House National Economic Council. Stephen Miran is chairman of the White House Council of Economic Advisers.