President Donald Trump pushes Fed to lower interest rates

President Donald Trump sent a note to the Fed chair asking him to lower interest rates.

WASHINGTON ― President Donald Trump keeps striking out in his months-long campaign to pressure Federal Reserve Chairman Jerome Powell to lower interest rates.

So on June 30, he pursued a new tactic: publicizing a handwritten note that he sent to Powell.

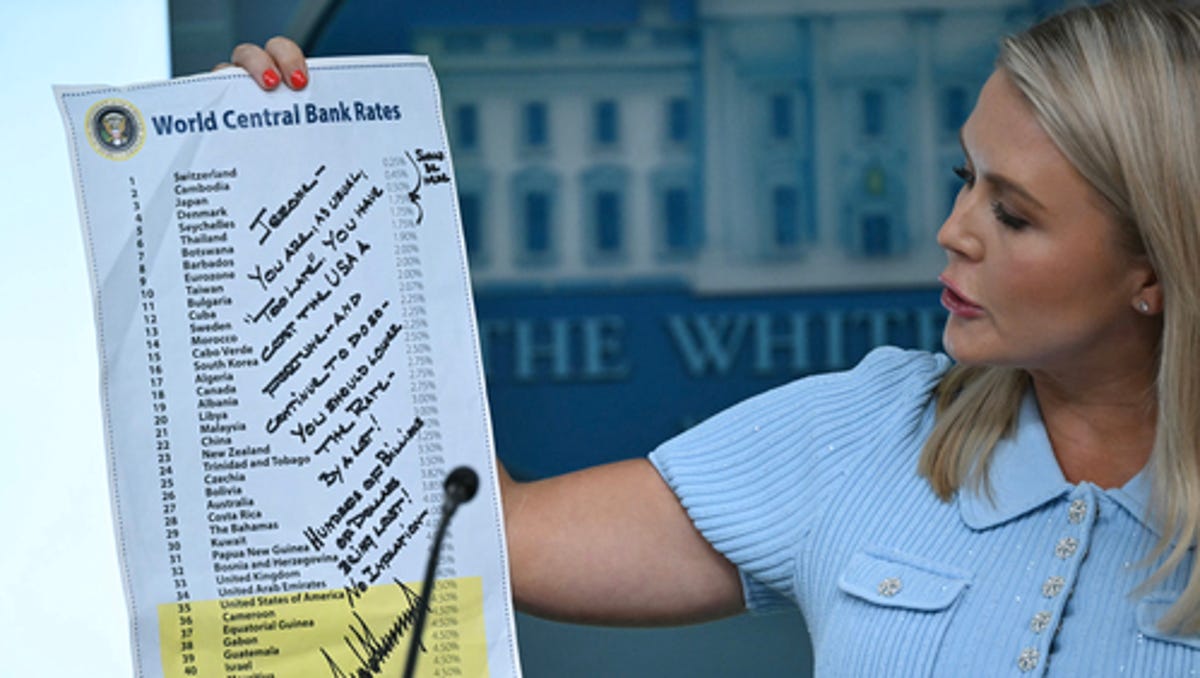

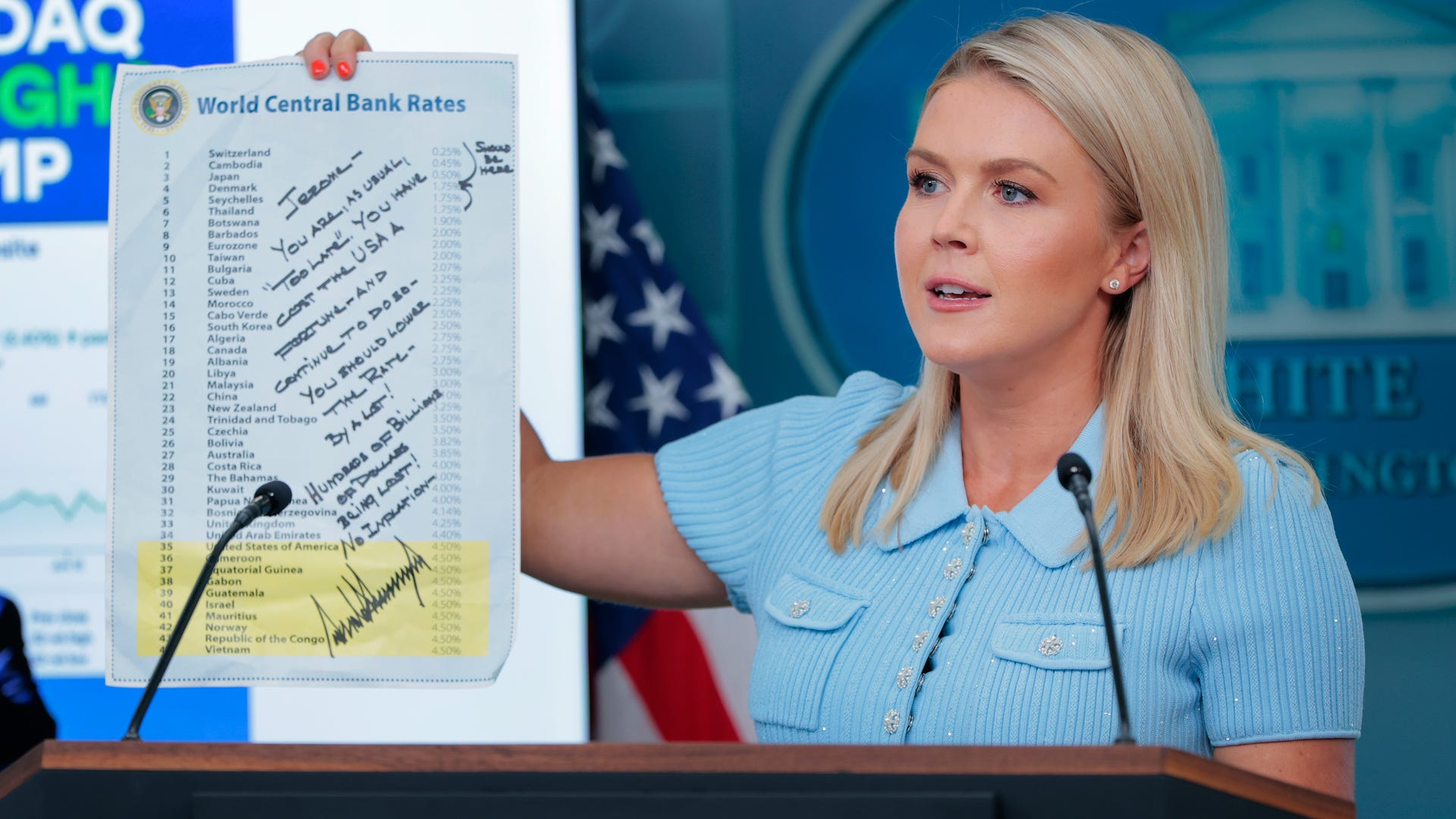

“You are, as usual, ‘Too Late,'” Trump wrote to Powell in a note shared on the president’s social media app Truth Social. “You have cost the USA a fortune and continue to do so. You should lower the interest rate by a lot! Hundreds of billions of dollars being lost! No inflation.”

Trump penned the note, accompanied with his signature, alongside a list of central banking rates set by nations across the world, ranging from the lowest, Switzerland’s .25%, to the United States and nine other countries that have 4.5% rates, ranking the 35th lowest.

“Should be here,” Trump wrote with two arrows pointing to a rate landing somewhere between Japan’s .5% and the 1.75% rates of Denmark, Seychelles and Thailand.

White House press secretary Karoline Leavitt held up an oversized version of the letter during a briefing Monday with reporters. “I would remind the Fed chair, and I would remind the entire world, that this is a president who was a businessman first, and he knows what he is doing,” Leavitt said.

“The American people want to borrow money cheaply, and they should be able to do that, but unfortunately, we have interest rates that are still too high,” she said.

The Federal Reserve on June 18 held interest rates steady at a range between 4.25% and 4.5% for a fourth straight meeting despite Trump’s public lobbying for a lower rate and his insults directed at Powell.

The White House has argued that inflation of just 2.4% in May warrants lower interest rates. But Powell has cited projected rising inflation from Trump’s massive tariffs on imports ‒ which went into effect only recently ‒ as a reason to keep rates unchanged.

Powell told members of the House Financial Services Committee last week that the Fed plans to assess the effects of Trump’s tariffs on inflation before lowering rates. He said “tariffs this year are likely to push up prices and weigh on economic activity,” noting it’s not clear if the effects will reflect a “one-time shift in the price level” or something “more persistent.”

Powell agreed that inflation has eased in recent months but cited economic forecasters’ projections for “a meaningful increase in inflation” from Trump’s tariffs.

Despite his criticism, Trump in April said he has “no intention” of firing Powell, who Trump nominated in his first term to serve a 10-year term on the Fed’s board of governors that ends in 2028. The president cannot legally fire the Fed chair under current law.

Powell’s term as Fed chairman ends in May 2026. And Trump last week said he’s already started the search to replace Powell and has about “three or four people” he’s considering. Bloomberg News reported Treasury Secretary Scott Bessent’s name has circulated as one option.

Trump is seeking a Supreme Court ruling that would give him the power to fire members of other independent boards, but his administration says it is not seeking that authority for the Fed specificially. A majority of Supreme Court justices signaled in a May 22 ruling they believe Trump wouldn’t be allowed to fire Powell, arguing the Federal Reserve is “a uniquely structured, quasi-private entity” that is different than other independent agencies. The line was contained in a Supreme Court opinion allowing Trump to fire two federal labor board members.

Asked by a reporter why Trump hasn’t fired Powell, Leavitt said: “It’s a good question and one you can ask the president.”

Contributing: Paul Davidson of USA TODAY

Reach Joey Garrison on X @joeygarrison.