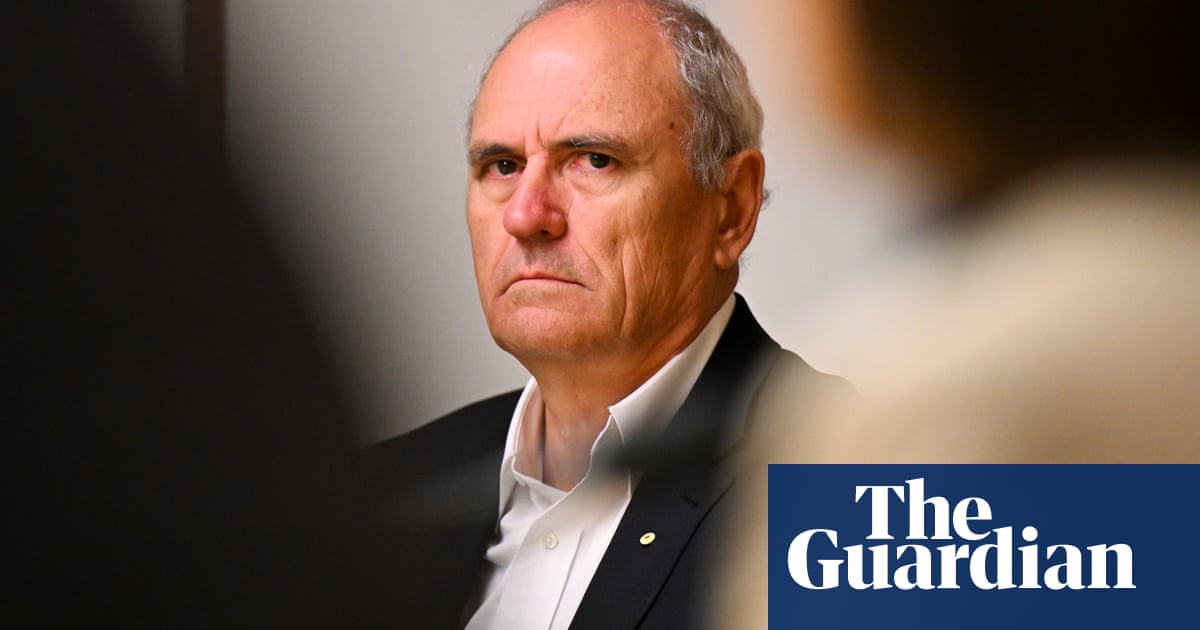

Recent governments have carried out “wilful acts of bastardry” and created intergenerational inequality and environmental destruction that will leave younger voters worse off, the former Treasury secretary Ken Henry has said, urging tweaks to Australia’s tax system to bridge the growing divide.

Henry, who worked under both the Howard and Rudd governments, used a speech at the Per Capita tax summit in Melbourne on Thursday morning to argue the country’s tax settings since the Howard government have fuelled inequality and left further generations and young workers “to pick up the tab”.

“Young workers are being robbed by a tax system that relies increasingly upon fiscal drag,” he said.

“Fiscal drag forces them to pay higher and higher average tax rates, even if their real incomes are falling.”

He said young workers were being denied the “reasonable prospect of home ownership” are “burdened by the punishing costs of securing a tertiary education”, will have to handle catastrophic environment destruction and “deal with the increasing costs of carbon abatement and climate change adaptation”.

“You simply can’t achieve something like that by accident,” he said. “Reckless indifference, perhaps. Wilful acts of bastardry, more likely. Accident, no.

“This is how a democracy works if those accorded the right to vote choose merely to look after themselves, with no codes, charters or transparency guarantees to protect the public interest.”

In 1998 Henry helped create the charter of budget honesty, which ensures governments are obliged to pursue sound fiscal management for the medium term.

“There can be no debate that every Australian government since the Rudd government has failed to meet its obligations, under the act, to do these three things: one, manage financial risks arising from erosion of the tax base; two, maintain the integrity of the tax system; and three, have regard to intergenerational equity,” he said.

He said voters were electing populist governments that acted in self-interest, not in the interest of future prosperity and equality.

“The Australian mining and native forest logging industries, collectively, employ only about 2% of the labour force,“ he said.

“We have political leaders who insist that mining and forestry underwrite Australian prosperity. I will state it plainly. Those who believe this nonsense cannot be trusted with the wellbeing of future generations.”

after newsletter promotion

The plunder of natural capital, including non-renewable resources, and environmental degradation, underinvestment in infrastructure, and “public debt accumulated to finance current spending” were the key drivers of inter-generational theft, he said.

“If democracy is to work for future generations, that is, if it is to deliver sustainability, then its custodians in the present must accept responsibility for the wellbeing of those who follow,” he said.

To mitigate the growing inequality, he said governments should broaden the GST, reform payroll tax and remove taxes on insurance, which stop people taking out cover.

He called for an overhaul on capital gains tax to make property more affordable and a higher tax on economic rents, like high profits of resources.

“We should also levy a carbon tax on Australia’s fossil fuel exports before importing countries do it to us,” he said. “The carbon embodied in these exports is about three times our net domestic emissions.”